We provide professional training to our students for their different accounting needs.

Setting up new clients, suppliers, vendors, and new hires in different accounting software and updating information for existing parties – Simply accounting and Quick Books.

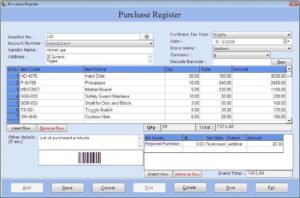

Voucher entries, journal entries, posting them in to different Ledger accounts.

Preparing Trading and profit and loss account and income statements.

Cash Flows – cash inflows and cash outflows.

Accounts Receivable and Accounts Payable and training for accurate coding and reviewing before finalization and submission.

Preparing, reviewing and finalizing Balance Sheets.

Various account statements, bank statements and their reconciliation.

Doing adjustment entries, refund to buyers and recoveries from vendors.

Doing adjustment entries, refund to buyers and recoveries from vendors.

Corporate accounting – share capital accounting.

Cost Accounting.

Forecasting, budgetary, various budgets, budgetary controls etc.

Payroll – Setting up new hires and updating existing employees information.

Payroll entries, training for various deductions, vacation adjustments to reach at net salaries and wages.

Payroll entries, training for various deductions, vacation adjustments to reach at net salaries and wages.

Preparing students to file personal and professional income tax returns etc.

AUDITING, AUDITING, AND AUDITING various account books, accounts, expenditure summaries and whole accounting cycle, finding discrepancies and correcting them according to established rules and standards for different profit and non-profit organizations.

For more details about Accounting Preparation Classes in Canada contact us @ +1 (780) 667-0039.